We invest in shares of gold mining companies, precious metal related companies and resources based companies. We also invest in gold bullion shares, other transferable securities, money market instruments, deposits, collective investment schemes and warrants.

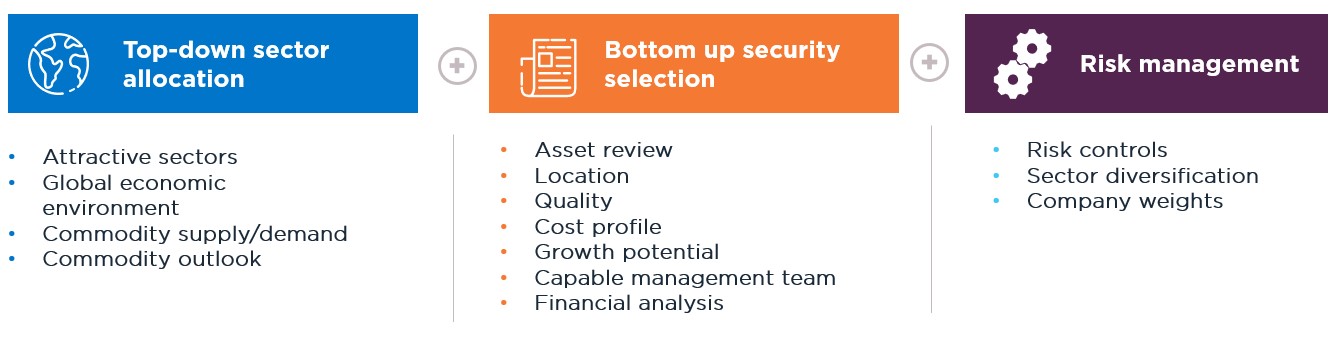

We seek both income and capital growth using a top-down and bottom-up investment approach with extensive due diligence.